Unlocking The Secrets Of Broome County: A Comprehensive Guide To The Tax Map

Unlocking the Secrets of Broome County: A Comprehensive Guide to the Tax Map

Related Articles: Unlocking the Secrets of Broome County: A Comprehensive Guide to the Tax Map

Introduction

With great pleasure, we will explore the intriguing topic related to Unlocking the Secrets of Broome County: A Comprehensive Guide to the Tax Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unlocking the Secrets of Broome County: A Comprehensive Guide to the Tax Map

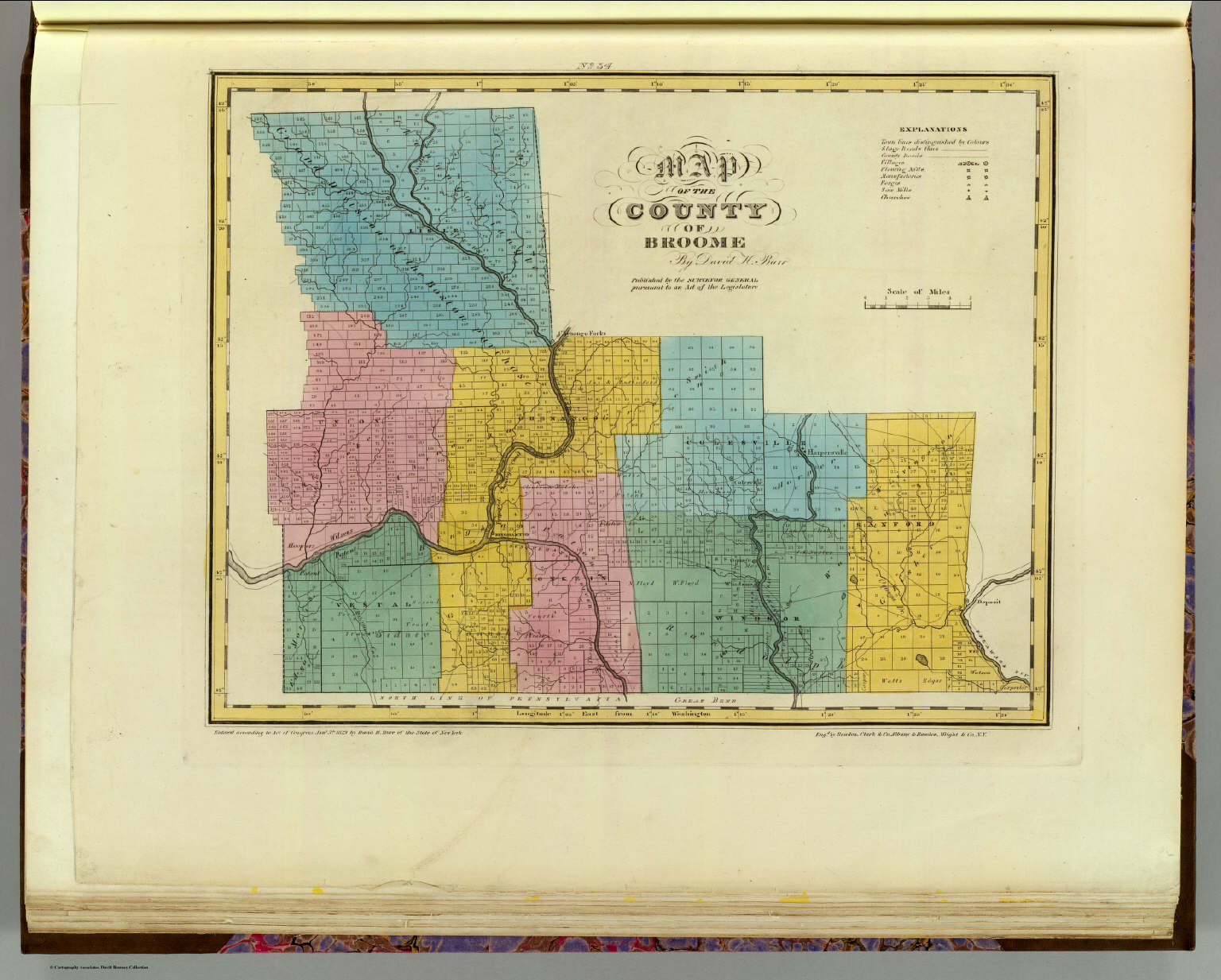

Broome County, New York, boasts a rich history and diverse landscape. This region, encompassing the vibrant city of Binghamton and surrounding townships, is home to a thriving community. Like any organized municipality, Broome County relies on a robust system for managing its land and property, and at the heart of this system lies the Broome County Tax Map.

This indispensable resource serves as a comprehensive guide to the county’s real estate, providing vital information for residents, businesses, and government entities alike. Understanding the Broome County Tax Map unlocks a world of insights, enabling informed decision-making across various sectors.

Navigating the Map: A Detailed Exploration

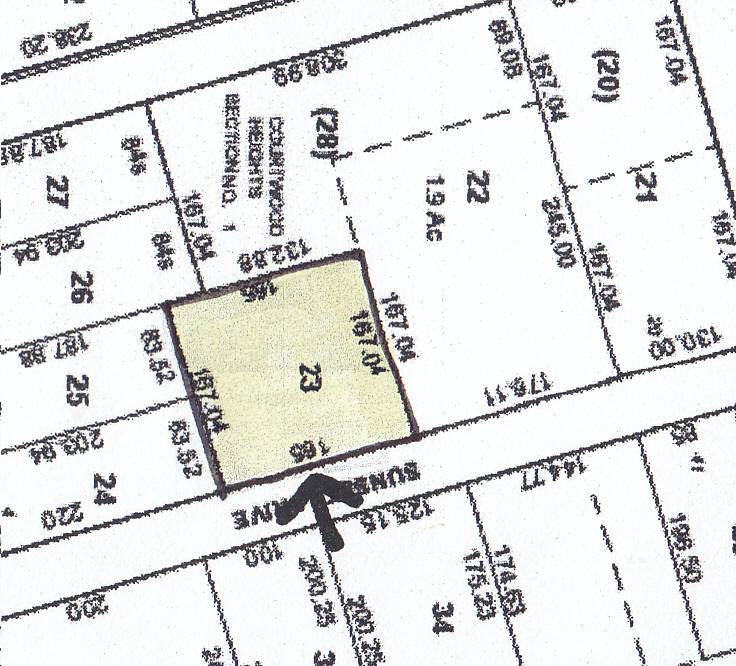

The Broome County Tax Map is not a single, static document but rather a sophisticated system encompassing various components. At its core lies a series of maps depicting the county’s land parcels. These maps are meticulously detailed, showcasing property boundaries, street names, and other relevant geographical features.

Each property is assigned a unique parcel identification number (PIN), serving as its digital fingerprint within the system. This PIN is the key to unlocking a wealth of information about a specific property, including:

- Owner’s name and address: This information is crucial for communication regarding taxes, property records, and other relevant matters.

- Property description: Detailed descriptions encompass the size, shape, and legal description of the land parcel.

- Assessment details: This section outlines the assessed value of the property, forming the basis for calculating property taxes.

- Zoning information: This data clarifies the permitted uses of the property, ensuring compliance with local regulations.

- Building details: The map may also include information about buildings on the property, such as their size, type, and construction materials.

Beyond the Maps: Accessing the Data

While the maps provide a visual representation of the land, the true power of the Broome County Tax Map lies in the associated database. This digital repository houses all the information linked to each property, accessible through various methods:

- Online portal: The Broome County government website offers an online portal where users can search for specific properties using the PIN or other search criteria. This online platform provides a convenient and readily accessible way to access property information.

- Data downloads: The county may provide options to download property data in various formats, allowing for further analysis and integration with other systems.

- Public access: County offices, such as the assessor’s office, typically offer public access to the tax map data, enabling in-person inquiries and document retrieval.

Importance and Benefits: Unveiling the Significance

The Broome County Tax Map plays a pivotal role in various aspects of county administration and community life, providing a multitude of benefits:

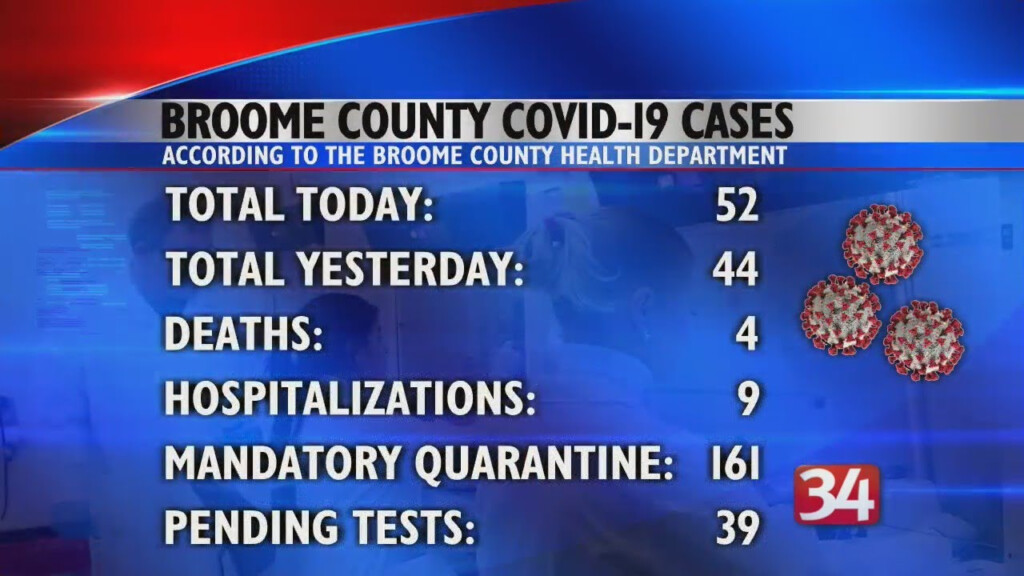

1. Property Taxation: The tax map forms the backbone of the property tax system. By accurately identifying and assessing properties, the county ensures a fair and equitable distribution of the tax burden. This information is essential for calculating property taxes, ensuring that each property owner contributes their fair share to the county’s revenue.

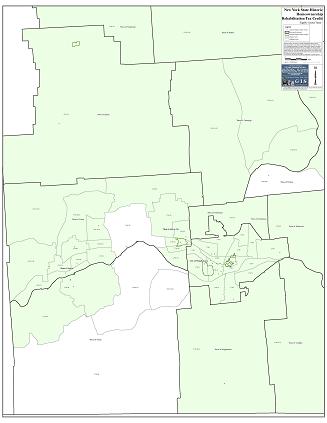

2. Land Management and Development: The map serves as a vital tool for planning and managing land use within the county. Developers, real estate professionals, and government agencies rely on the map to identify suitable properties for development, assess environmental impacts, and ensure compliance with zoning regulations. This comprehensive understanding of the county’s land resources facilitates informed decisions regarding development projects, infrastructure planning, and environmental conservation.

3. Public Safety and Emergency Response: The tax map provides crucial information for emergency responders, enabling them to quickly and accurately locate properties during emergencies. This information is particularly valuable during natural disasters, fires, or other incidents requiring immediate response, ensuring efficient and effective emergency services.

4. Historical Research and Community Development: The Broome County Tax Map serves as a valuable historical resource, providing insights into the county’s land ownership and development patterns over time. This information can be used for historical research, community development projects, and understanding the evolution of the county’s landscape.

5. Transparency and Accountability: By making the tax map publicly accessible, the county promotes transparency and accountability in its land management practices. This open access fosters trust and allows residents, businesses, and stakeholders to hold the county accountable for its decisions regarding land use, taxation, and other related matters.

FAQs: Addressing Common Questions

Q: How can I access the Broome County Tax Map?

A: The most convenient method is through the county’s official website, where an online portal typically provides access to the map and associated data. Alternatively, you can visit the county assessor’s office for in-person access.

Q: What information can I find on the tax map?

A: The map provides detailed information about each property, including owner’s name, address, property description, assessment details, zoning information, and building details.

Q: How can I use the tax map for my business?

A: The map is an invaluable resource for businesses involved in real estate, development, and construction. It can help identify suitable properties, assess development potential, and ensure compliance with zoning regulations.

Q: How often is the tax map updated?

A: The Broome County Tax Map is typically updated annually to reflect changes in property ownership, assessments, and other relevant data.

Q: Is the tax map accurate and reliable?

A: The county strives to maintain the accuracy and reliability of the tax map through regular updates and verification processes. However, it’s always advisable to verify information with the county assessor’s office when making critical decisions based on the map.

Tips: Maximizing the Map’s Utility

- Utilize the online portal: This is the most convenient and efficient way to access the tax map and its associated data.

- Familiarize yourself with the map’s features: Understanding the symbols, legends, and search functions will enhance your ability to navigate the map effectively.

- Contact the assessor’s office: For specific questions or clarification, reach out to the county assessor’s office for expert guidance.

- Compare data sources: Cross-referencing information from the tax map with other sources, such as deeds or property records, can help ensure accuracy and completeness.

- Stay informed about updates: The county typically announces updates to the tax map through its website and other official channels.

Conclusion: Empowering Informed Decisions

The Broome County Tax Map is an essential resource for residents, businesses, and government agencies alike. By providing comprehensive and accurate information about the county’s land and property, it empowers informed decision-making across various sectors. Whether you’re a homeowner, developer, or simply curious about your community, understanding the Broome County Tax Map unlocks a wealth of insights and opportunities.

Closure

Thus, we hope this article has provided valuable insights into Unlocking the Secrets of Broome County: A Comprehensive Guide to the Tax Map. We hope you find this article informative and beneficial. See you in our next article!

You may also like

Recent Posts

- A Comprehensive Guide To The Map Of Lakewood, California

- Thailand: A Jewel In The Heart Of Southeast Asia

- Navigating The Nation: A Guide To Free United States Map Vectors

- Navigating The Tapestry Of Arkansas: A Comprehensive Guide To Its Towns And Cities

- Mapping The Shifting Sands: A Look At 9th Century England

- A Journey Through Greene County, New York: Exploring The Land Of Catskill Mountains And Scenic Beauty

- The United States Of America In 1783: A Nation Forged In Boundaries

- Unraveling The Magic: A Comprehensive Guide To The Wizard Of Oz Map In User Experience Design

Leave a Reply