Navigating Maui’s Landscape: A Guide To The Tax Map Key

Navigating Maui’s Landscape: A Guide to the Tax Map Key

Related Articles: Navigating Maui’s Landscape: A Guide to the Tax Map Key

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating Maui’s Landscape: A Guide to the Tax Map Key. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Maui’s Landscape: A Guide to the Tax Map Key

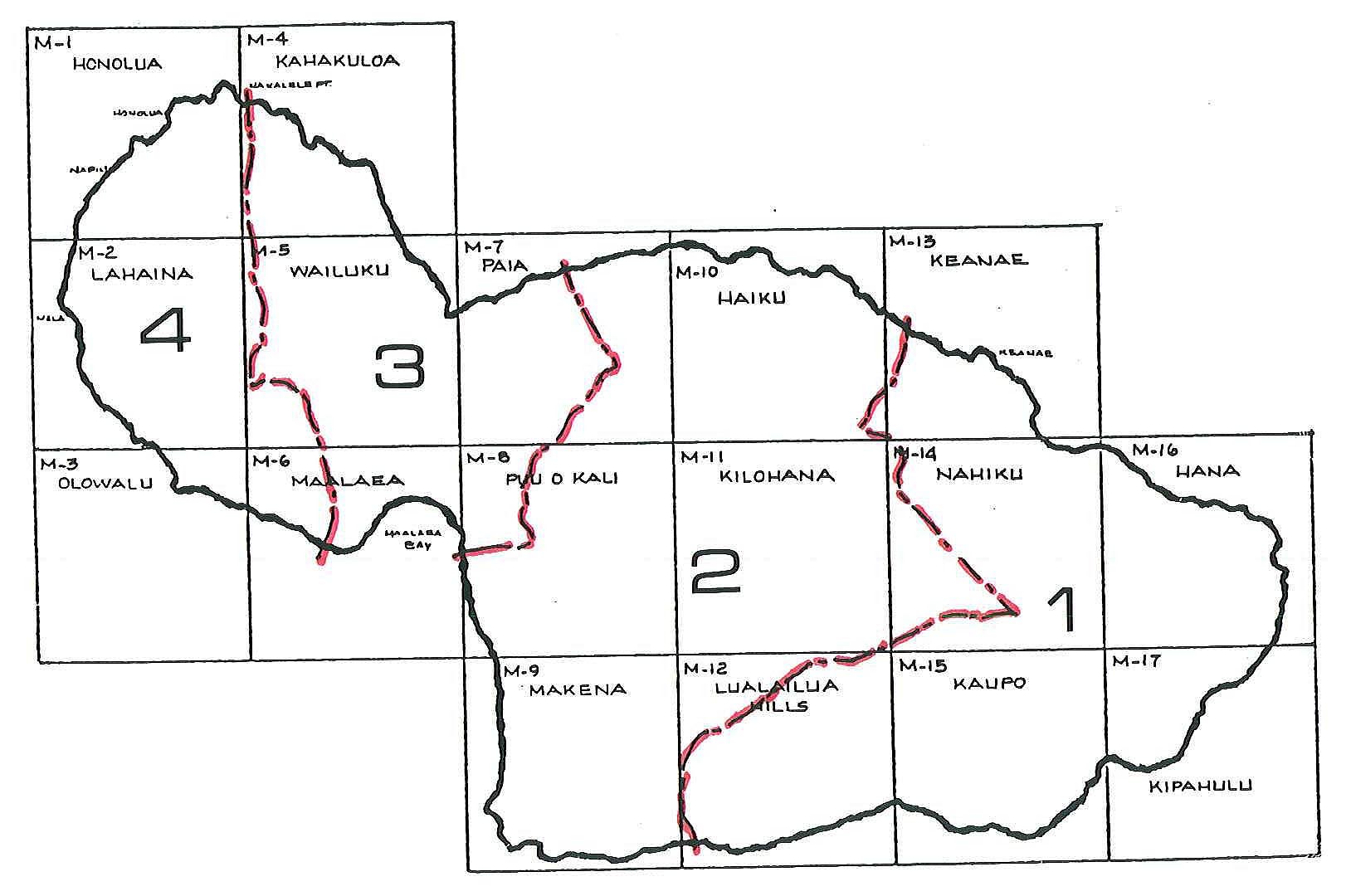

The island of Maui, with its breathtaking beauty and diverse terrain, presents a unique challenge for property identification and management. Enter the Tax Map Key, a critical tool employed by the County of Maui to accurately locate and categorize every parcel of land within its jurisdiction. This system, akin to a detailed roadmap, offers a comprehensive understanding of Maui’s real estate landscape, providing invaluable information for a wide range of stakeholders.

Understanding the Tax Map Key:

The Tax Map Key, essentially a numerical and alphabetical code, serves as a standardized method for identifying properties. It is a hierarchical system, organized into distinct sections that break down Maui’s geography into progressively smaller units.

- District: This represents the broadest level of division, encompassing major geographical areas of Maui. Districts are denoted by letters, such as "A" for West Maui or "B" for Central Maui.

- Section: Further dividing districts, sections are numbered sequentially within each district. These sections represent smaller geographical regions within the larger district.

- Subsection: Breaking down sections into even smaller units, subsections are also numbered sequentially within each section.

- Parcel: The most granular level of the Tax Map Key, parcels represent individual properties or land holdings within a subsection. Parcels are identified by a unique number, often followed by a letter or number to distinguish between multiple parcels within the same subsection.

Benefits of the Tax Map Key:

The Tax Map Key is not merely a system of identification; it provides a wealth of information about each property, making it a valuable resource for:

- Property Owners: Understanding the exact location and boundaries of their property, as well as its legal description, is crucial for property management, transactions, and legal matters. The Tax Map Key provides this crucial information.

- Real Estate Professionals: Agents, appraisers, and other professionals rely on the Tax Map Key to conduct property searches, analyze market trends, and assess property values.

- Government Agencies: The Tax Map Key facilitates efficient tax collection, property assessments, and land use planning by providing a clear and consistent system for identifying and managing properties.

- Developers and Investors: The Tax Map Key assists in identifying potential development sites, understanding zoning regulations, and assessing the suitability of properties for specific projects.

- Emergency Services: First responders utilize the Tax Map Key to quickly locate properties during emergencies, ensuring prompt and accurate assistance.

Accessing the Tax Map Key:

The County of Maui’s website provides access to the Tax Map Key through its online mapping system. Users can easily search for properties by address, parcel number, or other criteria. The system displays a detailed map, highlighting the property’s location, boundaries, and associated information.

Beyond Identification: The Tax Map Key’s Additional Value:

The Tax Map Key’s utility extends beyond simple property identification. It also serves as a foundation for:

- Property Records: The Tax Map Key links to a comprehensive database of property records, including ownership information, tax assessments, and historical transactions.

- Land Use Planning: The Tax Map Key is used to identify areas designated for specific land uses, such as residential, commercial, or agricultural. This information is crucial for developers and investors seeking to understand zoning restrictions and development potential.

- Environmental Management: The Tax Map Key is used to map sensitive environmental areas, such as wetlands and coastal zones, aiding in conservation efforts and sustainable development practices.

FAQs Regarding the Tax Map Key:

Q: How can I find the Tax Map Key for my property?

A: The County of Maui’s website provides an online mapping system where you can search for properties by address, parcel number, or other criteria. The system will display the property’s Tax Map Key along with other relevant information.

Q: What information can I find using the Tax Map Key?

A: The Tax Map Key provides information about the property’s location, boundaries, ownership, tax assessment, legal description, zoning regulations, and more.

Q: Is the Tax Map Key used for all properties in Maui?

A: Yes, the Tax Map Key is used to identify and categorize all properties within the County of Maui, including residential, commercial, agricultural, and vacant land.

Q: Can I use the Tax Map Key to find out the value of my property?

A: While the Tax Map Key does provide the assessed value for tax purposes, it does not reflect the current market value of the property.

Tips for Utilizing the Tax Map Key:

- Familiarize yourself with the hierarchical structure: Understanding the district, section, subsection, and parcel system will enable you to efficiently navigate the Tax Map Key.

- Use the online mapping system: The County of Maui’s website provides an interactive mapping tool that allows you to search for properties and view their Tax Map Key information.

- Consult with a professional: If you have any questions or need assistance using the Tax Map Key, consult with a real estate professional or a representative from the County of Maui’s Department of Finance.

Conclusion:

The Tax Map Key is an indispensable tool for understanding and navigating Maui’s diverse landscape. Its comprehensive nature, accessibility, and integration with property records and land use planning systems make it a valuable resource for property owners, real estate professionals, government agencies, and anyone seeking to understand the island’s real estate landscape. By utilizing the Tax Map Key, individuals and organizations can make informed decisions regarding property management, development, and investment, ensuring a clear and efficient approach to navigating Maui’s unique real estate environment.

Closure

Thus, we hope this article has provided valuable insights into Navigating Maui’s Landscape: A Guide to the Tax Map Key. We hope you find this article informative and beneficial. See you in our next article!

You may also like

Recent Posts

- A Comprehensive Guide To The Map Of Lakewood, California

- Thailand: A Jewel In The Heart Of Southeast Asia

- Navigating The Nation: A Guide To Free United States Map Vectors

- Navigating The Tapestry Of Arkansas: A Comprehensive Guide To Its Towns And Cities

- Mapping The Shifting Sands: A Look At 9th Century England

- A Journey Through Greene County, New York: Exploring The Land Of Catskill Mountains And Scenic Beauty

- The United States Of America In 1783: A Nation Forged In Boundaries

- Unraveling The Magic: A Comprehensive Guide To The Wizard Of Oz Map In User Experience Design

Leave a Reply